You’ve probably seen that the prices for everything are rising. Prices of things such as gasoline, cars, food, rent, house mortgages, etc have increased. This, my friends, is called inflation. The 5 main causes of inflation are an increase in wages, an increase in the price of raw materials, an increase in taxes, a decline in productivity, and an increase in the money supply.

Inflation can be financially dangerous, and in this post, I’m here to convince you to care about the negative effects of inflation. So? What would make you care?

JUMP TO A SECTION:

- Would The Numbers Make You Care?

- Would The Photos Make You Care?

- Would The Experts Make You Care?

- Would The Stories Make You Care?

- Call to Action – What Can YOU Do?

- Works Cited

- Closing

It’s a typical thing when the economy grows, but it’s bad. Imagine going to a local grocery store to buy something for $10 which you used to get for $5 which your grandfather used to get for $2. Say a pack of batteries or some apples? Meet inflation.

People all over the United States are facing this issue. That’s 331.9 million people and counting! That’s a whole country’s people facing an economic crisis which could end up wrecking the nation by throwing it into a recession. And a recession means homelessness, depression, political issues, etc.

But why would you care if you’re going steady economically right now? Which reason would make you care? There are thousands of reasons why you may not care. Be that as it may, you should care about this economic crisis because you are the one being affected by inflation, some time or the other! The consumers are affected, and consumers mean you! Isn’t that just obnoxious? Think of what your future generation would be like? Why pay more for something worth less?! What Would Make You Care About The Negative Effects Of Inflation?

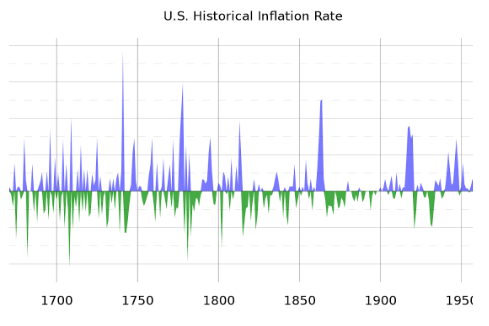

Would The Numbers Make You Care?

“The overall consumer price index (CPI) increased by 7.7% over the past 12 months (October 2021- October 2022).”

Shocking! Why people should care about inflation you ask? Well here’s proof: The CPI. The CPI means the Consumer Price Index, and it measures the inflation in the economy. The lower the CPI rate, the better the economy. And with the current rise, the inflation and the economy are almost at a crisis point. But really, why should you care? Because you are the one being affected, since you are the consumer, and because prices are going up, you’d have to pay more for things you want to buy. If the CPI rates go higher, that could indicate that the market could go into recession, which is overall bad for consumers! Consumers like YOU.

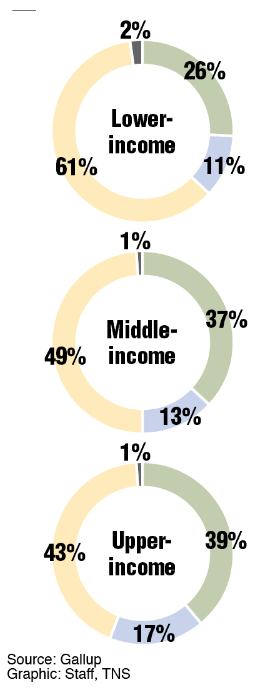

“49% of middle-income, 61% of low-income, and 43% of high-income individuals are worse off financially this year.”

As an average that would be 51% of the US population. That is millions of people. And the big reason behind this: Inflation! An ideal consumer, just like you of any class, people would not like this to happen. Do you want to be worse off financially? Do you care for your future and what will happen. You may not, but would the statistics make you care, sooner or later? I hope so.

Would The Photos Make You Care?

People Affected By Inflation!

Do you see this guy? Prices are going up for everything, and he has bills to pay! Imagine if you were in his position if you already aren’t. Don’t want to? Well, imagine a friend struggling financially. If this inflation thing rises, then common consumers like you will be affected just like the man in the picture. The effects of inflation are negative, specifically on an individual. An individual like you. If people don’t care about inflation, bad things can happen every day to them (not that they already aren’t happening to people) bad things such as homelessness, hunger, debt, etc.

Prices Are Soaring!

Simple things such as your needed groceries prices are increasing, and every person will be impacted by this. Why? Because everyone needs the bare necessities! Even people like you (however you are)! If these prices keep on soaring, nobody can afford simple groceries, unless you are crazy rich! Do you know why World Hunger exists? The reason is because people cannot afford food! Effects of inflation could end up in really bad things, and bad things are not could for consumers, just like you and I. But, really, would the photos make you care?

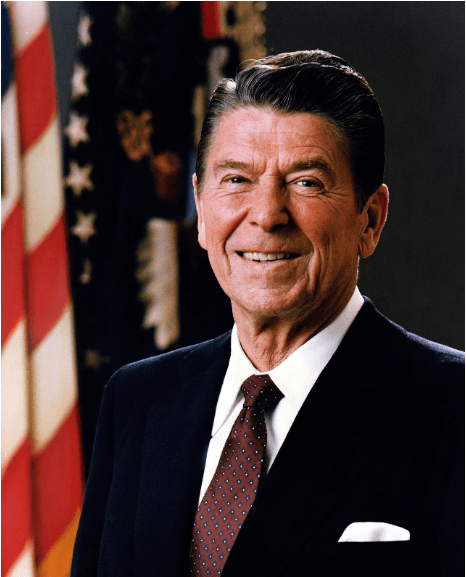

Would The Experts Make You Care?

“Inflation is as violent as a mugger, as frightening as an armed robber and as deadly as a hit man.” -40th POTUS of the US: Ronald Reagan

Previous President Ronald Reagan came to office during poor economic times, when the country was facing stagflation (high rates of inflation along with lots of people losing their jobs), and really helped to boost the country’s economy. And even though he is no “finance geek”, he still is the president who controlled the country from 1981-1989 and brought it out of the economic depression. His words may be very descriptive and tormenting, but they are very valuable because what he says is exactly what inflation is. Inflation can rob people and throw them homeless on the streets, mug all a person owns, and eventually kill them (starvation, debt, suicide, health, etc.). Now if you won’t trust or listen to the president that the whole country, even you supported, who will you? Would the experts even make you care?

Would The Stories Make You Care?

Call to Action – What Can YOU Do?

Inflation is a major financial issue for many, and an economic issue for the country, but can you really do something about it as a citizen? You cannot really visit the FED (Federal Economic Department) and convince them to end it because there are many conditions to put down inflation, such as the climbing interest rates, the housing market, etc. But, what you can do is save yourself from this incoming tidal wave! There are 5 things you can check out!

Works Cited

Shocking Statistic #1 –

25 Shocking U.S. Inflation Statistics [2022]: Is Inflation on the Rise? – Zippia. http://www.zippia.com/advice/inflation-statistics/.

Shocking Statistic #2 –

“Most People Say they are Worse off Financially than One Year Ago.” Tribune Content Agency Graphics, 2023. Gale In Context: Opposing Viewpoints, link.gale.com/apps/doc/BGSEAT509873421/OVIC?u=j246908&sid=bookmark-OVIC&xid=d17f43c8. Accessed 23 Mar. 2023.

Compelling Photo #1 –

Fielding, Sarah. “High Inflation Rates Impact Almost Every Aspect of Our Lives, Including Mental Health.” Verywell Mind, 31 July 2022, http://www.verywellmind.com/how-rising-inflation-is-impacting-mental-health-5546955.

Compelling Photo #2 –

Luther, William J. “FOMC Projects Even Higher Inflation | AIER.” Www.aier.org, http://www.aier.org/article/fomc-projects-even-higher-inflation/. Accessed 23 Mar. 2023.

Expert Quote #1 –

“Inflation Quotes.” Www.famousquotes123.com, http://www.famousquotes123.com/inflation-quotes.html. Accessed 23 Mar. 2023.

Anecdotal Story #1 –

“Tell Us Your Inflation Stories.” Financial Times, 26 Aug. 2022, www.ft.com/content/a91bcc0d-fd2e-4127-8541-834c8fb0dcfe.

Anecdotal Story #2 –

CNN, Analysis by Zachary B. Wolf. “Analysis: The Good, the Bad and the Unknown of the Inflation News.” CNN, http://www.cnn.com/2022/08/10/politics/inflation-interest-rates-what-matters/index.html.

Anecdotal Story #3 –

“CNN 10: The Big Stories of the Day, Explained in 10 Minutes – CNN Video.” Www.cnn.com, http://www.cnn.com/videos/cnn10/2023/02/15/ten-0216orig.cnn. Accessed 31 Mar. 2023.

Anecdotal Story #4 –

“CNN 10: The Big Stories of the Day, Explained in 10 Minutes – CNN Video.” Www.cnn.com, http://www.cnn.com/videos/cnn10/2023/02/15/ten-0216orig.cnn. Accessed 31 Mar. 2023.

Closing

So, folks, I hope that study was interesting to you, and I hope that it encourages you to reconsider and improve your finances! Please leave your comments and feedback below, and for more content like this, leave a like on this post and subscribe to my blog!

BEWARE OF INFLATION!!!!